First, COVID-19. According to Live Science[i] last week, the virus had infected more than 75,000 people and killed 2,000, almost entirely in mainland China. Without minimising the suffering behind those numbers, it reports that, in the US alone, the flu has already caused an estimated 26 million illnesses, 250,000 hospitalisations and 14,000 deaths this winter.

In the largest study of COVID-19 cases to date, China’s Centre for Disease Control and Protection analysed 44,672 confirmed cases and found 80.9% to be mild, 13.8% severe, and 4.7% (2,087) critical. They estimated the death rate at 2.3%, which is much higher than the death rate from US flu cases at around 0.1%—but both rates are extremely low.

It is also quite likely that the number of actual cases of infection is understated because many people have been infected but not shown symptoms. If this is so, then the death rate would be lower.

What’s unknown about the new virus is the bigger problem. Nobody knows exactly how it will spread or how many serious cases will develop.

Recent policy responses in Italy for example have caused a surge in levels of anxiety, although Johns Hopkins University data[ii] shows that this week the numbers of recovering patients has exceeded the numbers of new cases.

So, what about financial markets?

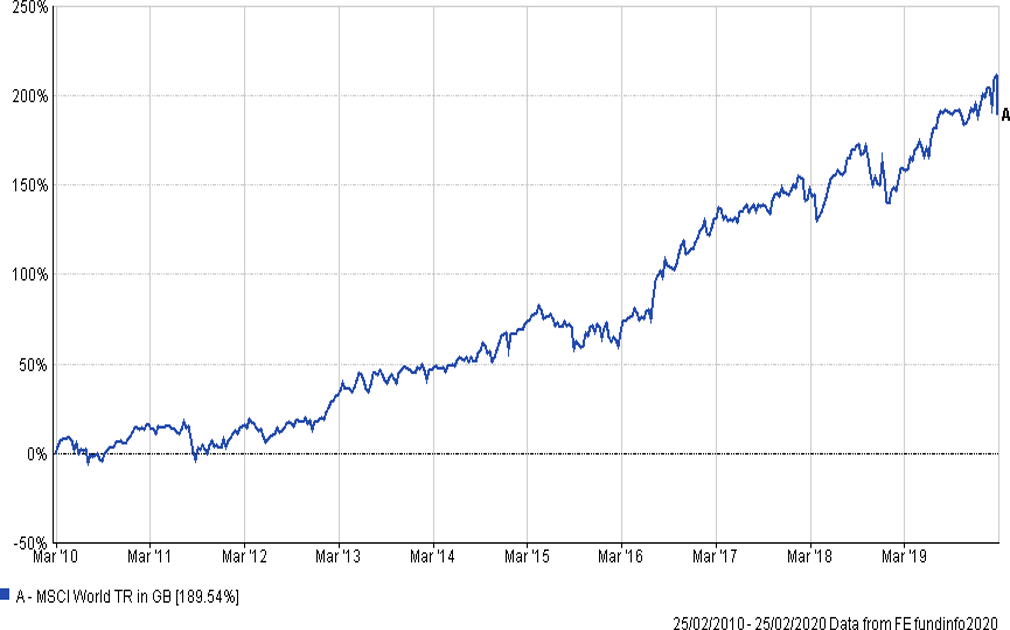

Equities have fallen quite sharply, but it is important to remember that they have risen consistently for a long time as the chart of global equity prices below shows.

Bonds, gold and safe haven currencies have all done well recently, as one would expect.

They will have done well because people have been concerned about the increased risk of recession. While this is also true of equities, there has also been some profit taking after recent gains in the equity markets.

The longer the uncertainty persists, the more people will fear that it will trigger a recessionary downturn, but despite the uncertainty about the spread and persistence of COVID-19, there are some things which we do know:

But should this cause long term erosion of equity values? No.

For equity prices to fall significantly further would historically have required one of the following: a loss of liquidity in the financial system; a rise in inflation; an increase in the cost of money; or lack of governmental or central bank policy support.

All these issues are currently constructive from an investor’s perspective, and likely to remain so.

The value of equities is based upon the very long term returns over many years. The value of these is much greater than the impact of a few quarters of disappointing profits.

In the absence of a significant escalation of COVID-19 related deaths and an extended global recession which we believe is unlikely we believe that investors should feel unsettled but not be panicking.